Ribbon: Decentralized Structured Products

2023-03-09 • Kaleb Rasmussen, Pearce Seabrook, Ronith Yalamanchili, Vishruth Madhusudhan

GM! Today, we’re going to explore Ribbon Finance, the dominant DOV (Decentralized Options Vault) provider. Ribbon was one of the first movers and the most mature protocol in the space contributing to their current TVL of 51MM. They offer a variety of structured products with their options-based strategies being the main attraction. Although Ribbon is still positioned as a leader in the space, DOVs have lost TVL along with the rest of the DeFi market.

Options Vault Overview

Yield is the primary goal in DeFi and is crucial for attracting a protocol’s TVL. Many DeFi protocols offering double digit yields are unsustainable as they utilize high issuance or leverage. DOV’s are one of the first DeFi products to offer sustainable double digit yield. DOVs create yield through three avenues: options premiums, staking rewards and token rewards. This organic yield from options premiums offers a sustainable solution by automating a market service previously only available to accredited investors in traditional finance.

Note: Yields are not risk free, unusual market movements may cause strategies to lose a portion of their deposits.

The TradFi options market offers investors a multifaceted way of structuring their portfolios to align with ever changing market scenarios. One way participants in the options market generate additional yield is through the overwriting of options on top of their current existing positions. Efficiently executing option strategies through centralized option venues is difficult as there are issues with scalability in size due to the illiquidity of their order book functions. DOVs allow for the scalable trading of options by concentrating liquidity on a specific range of strike prices. Moreover, they democratize access to the additional yield generated through selling volatility that has only been accessible to more sophisticated investors off-shore or through OTC desks.

How It Works

The Theta Vault is Ribbon’s signature product that allows users to gain exposure to a particular asset while also earning a weekly, sustainable yield on that asset. This organic yield is attained through the systematic sale of out of the money options and collection of those premiums.

Inner Workings

Users first deposit their asset into the appropriate vault. Every Friday at 11am UTC, the vault algorithmically selects the optimal strike price for the options. The Theta Vault then deposits the collateral in Opyn’s vault and mints European options (can only be executed at expiration) in the form of oTokens. These oTokens represent an options contract where they have a specific strike price and expiry. At expiration, the oToken gives the holder the right to redeem some amount of the underlying asset if the strike price is hit from the vault. The collateral is held in the vault until expiry in the case that the options expire in the money.

After the Vault has minted the oTokens, it sells them to the open market for a premium (denominated in the underlying asset). The vault sets a minimum price for the options and then allows anyone in the world to bid on the options via a blind auction on Paradigm. Those bets that are greater than or equal to the final clearing price receive the auctioned oTokens. The premium in the underlying asset (the yield) is then collected by the vault.

If the options expire out of the money, the collateral and premium are returned to the Theta Vault from the Opyn Vault. If the options expire in the money, option (oToken) holders can exercise their options by withdrawing collateral from the Opyn vault. The amount that can be withdrawn is equal to the difference between the price of the asset and the strike price at expiry. Any collateral leftover in the vault is returned back to the Theta Vault. Additionally, the vault charges a 2% annualized management fee as well as a 10% performance fee based on the premiums earned; however, if the weekly strategy is not profitable, no fees will be charged.

Strategies

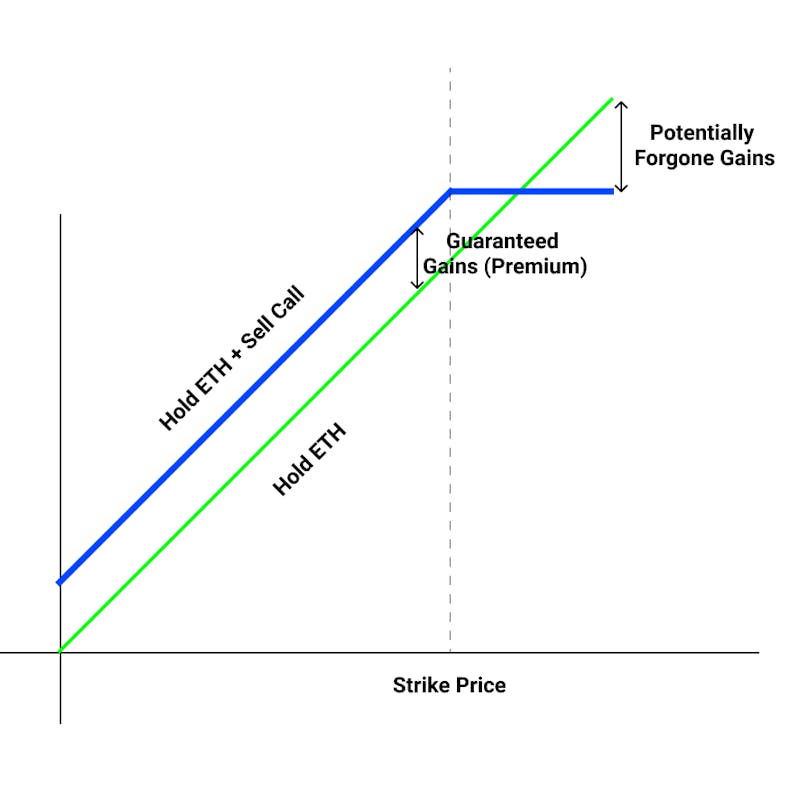

Ribbon deploys two main strategies in their vaults: the covered call and the cash secured put. Covered Call Vaults allow users to automatically earn yield by selling weekly out of the money call options on their deposited assets ($WBTC, $ETH, $AVAX, $SOL, $APE, etc). The biggest risk with this strategy is that if the deposited asset has a large rally within the week and the options expire in the money, the vault will be forced to sell the asset at the strike price and may have to forgo gains for the vault.

For example, let’s say $SOL is trading at $30 and you deposit 1 $SOL into Ribbon’s Covered Call Vault that sells an options contract at a $30 strike price. If $SOL rises to $40 by the end of the week, there will be $40 worth of $SOL in the vault plus the premiums you collected from selling the option. However, the option holder will likely exercise their option and remove some collateral from the vault. They will remove the $10 worth of $SOL which is the difference between the market price of $40 and the strike price of $30. After this occurs, there will be $30 of SOL plus the premium left in the vault for the depositor. So even though you had to forgo some gains, you are still up more than $10 from your initial deposit. However, as discussed later, it is expected that options are to be executed less than 5% of the time.

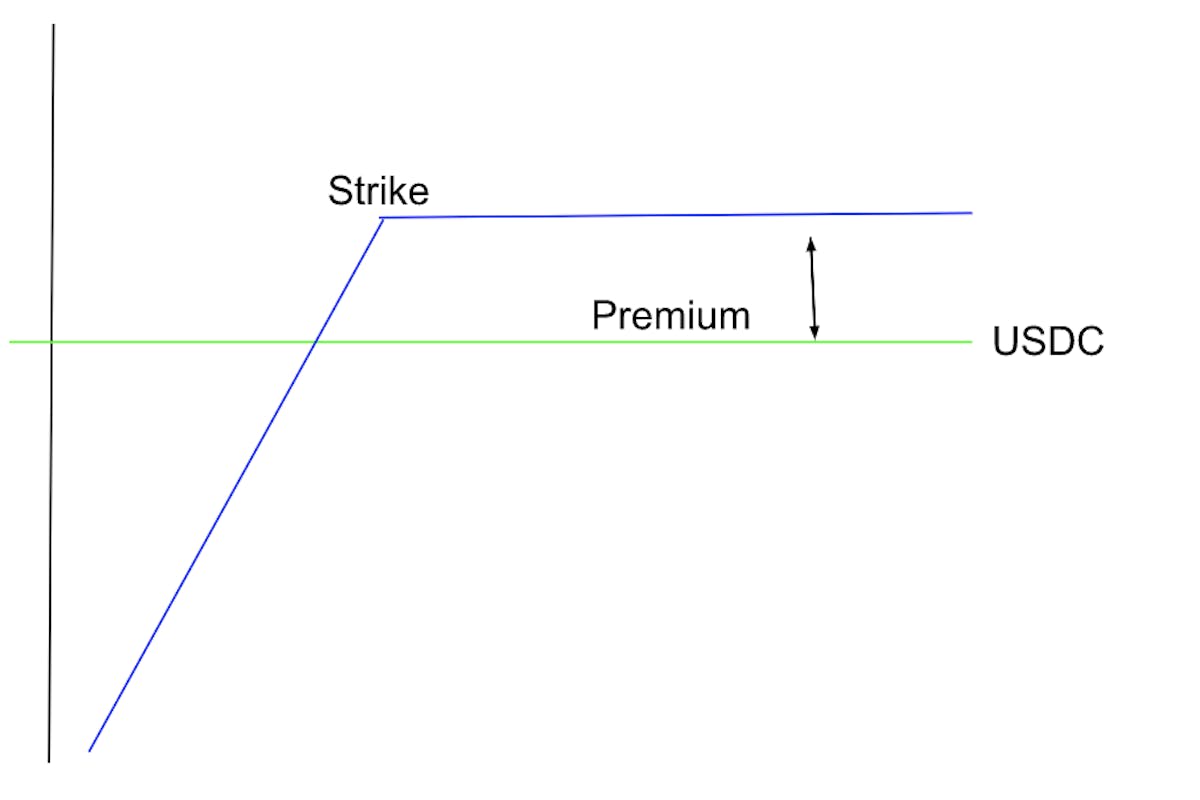

Cash Secured Put Vaults allow users to automatically earn yield by selling weekly out of the money put options on deposited USDC speculating on specific assets ($ETH, $AVAX). The biggest risk with this strategy is that if the deposited asset has a crash within the week and the options expire in the money, the vault will be forced to buy the speculated asset at the strike price and may incur a weekly loss.

Black-Scholes Equation

Unlike Ribbon V1 and other vaults which use humans to select strike prices, Ribbon V2 uses the Black-Scholes Equation (a mathematical formula that estimates the theoretical value of European options) to algorithmically compute strike prices.

Historical and implied volatility are both variables in the equation: historical volatility is retrieved from Uniswap while implied volatility is determined by a proprietary closed source algorithm. Both $ETH and $BTC use data from Deribit while a special algorithm is used to set it for other tokens.

Despite being designed for on-chain use, the equation is executed off-chain due to its high gas consumption as well as impracticality problems from rounding errors and the auction’s time frame.

Other Vaults

In addition to the Theta Vaults, Ribbon also offers Ribbon Earn and Ribbon Treasury Vaults. Ribbon Earn Vaults take the deposited funds and lend them out to creditworthy institutions. Ribbon then takes the interest collected and distributes a base APY of 4% back to the vault, and then invests the remaining interest into Ethereum At-The-Money Saddle Knockout Options.

So what does that even mean? Simply put, these options are bought at the current market price (At-The-Money) on Ethereum and increase in value as the price of $ETH increases or decreases away from its current market price (saddle); however, if $ETH’s price fluctuates by 8% by the end of the week, the options expire worthless (knockout). If $ETH’s price remains the same or the options expire worthless, the vault should still earn a base APY of 4% from lending. Demonstrated in the graph below, this vault allows you to get exposure to $ETH volatility in either direction up to a certain point.

Risks

The biggest risk lies in how effective Ribbon’s Theta Vaults are. Generally, Ribbon’s vaults are fairly effective at generating yield. However, in extremely volatile weeks where the market price reaches the strike price, strategies can produce losses which can cancel out many of the gains and generate a much lower realized return. As shown in the graph above, yield close to projected APY is achieved most weeks. But in those volatile weeks, the vault’s realized return can drop significantly. As such, looking at just the projected APY can sometimes be inaccurate to the full picture, as it does not include weeks when the vault incurred losses. While some vault’s actual performances are achieving close to their projected APY, it depends on the underlying assets performance and the vault strategy. Users should look at both the projected APY and the real past performance to truly understand each vault’s risk.

Ribbon Earn also has its own unique risks. While it claims to offer depositors “principal protected” yield, this can also be a bit misleading. Although this strategy avoids market volatility risk on its “principal protected” yield, this strategy exposes depositors to credit risk by lending out the principal. It is important to note there is always risk with any structured product, and in the case of Ribbon Earn, it’s mostly credit risk.

Another risk is the smart contract risk that comes with operating a platform where depositors funds are accumulated in large pools. It is important to note that both Opyn and Ribbon’s smart contracts could be prime targets for hackers. While this risk is hard to mitigate, it is still important for users to know that it exists.

Tokenomomics / Value Accrual

Token Allocation

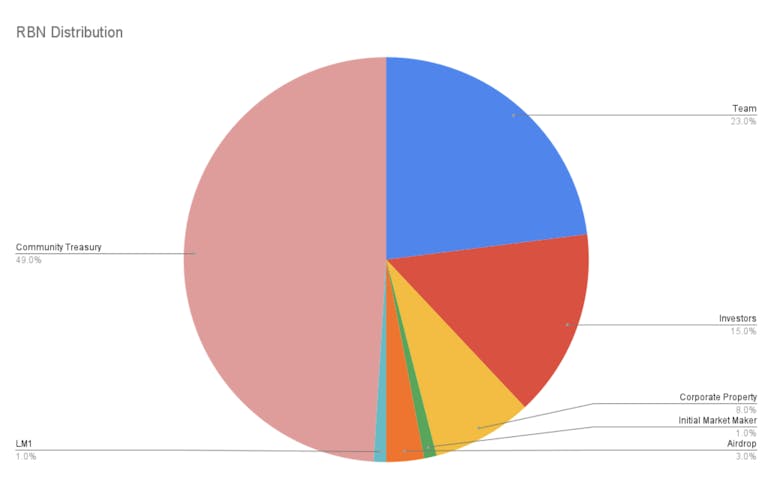

The token allocation is fairly standard with a significant portion allocated to the treasury. The treasury allocation is designed to launch various rewards programs for users to help support and grow the protocol. 53% of Ribbon’s supply of 1 billion tokens is currently in circulation, with the remaining supply being released over a couple years. Inflation is something to consider when investing but nothing unusual for the space.

Ribbonomics

The passage of RGP-9 in late February 2022 is one of Ribbon’s most significant updates. RBN-9 essentially affects two main groups within the Ribbon ecosystem, those who stake RBN for veRBN and vault depositors.

veRBN Overview

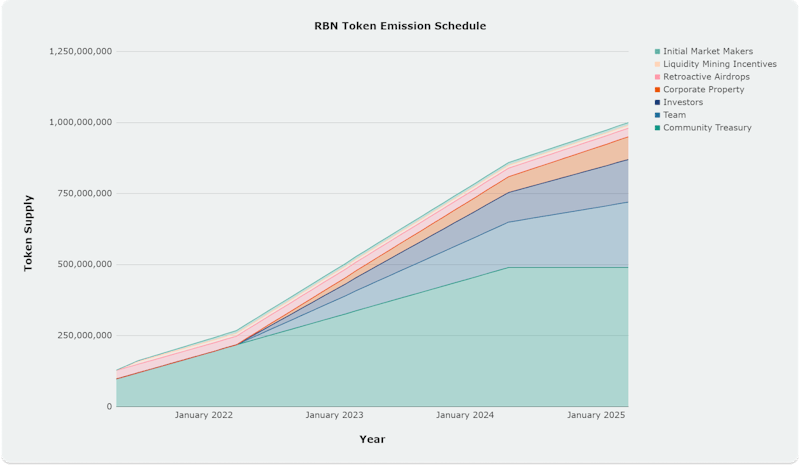

veRBN is non-transferable and has a maximum lock period of 2 years. The longer a user locks token for the more veRBN they receive. At 1 year 1 RBN = 1veRBN while at 2 years 1 RBN = 2 veRBN. If users want to unlock tokens early there is a penalty based on the time left to normal unlocking. This maxes out at 75% of locked RBN. To fund existing yields and generate RBN rewards, an emission schedule of 250K RBN per week over the course of six months – ~6.5M RBN overall (~0.65% of total supply) – was set while acknowledging that this could be adjusted before and as needed by both RBN and veRBN holders.

Benefits for depositors:

For vault depositors “Gauges” are set up for each option vault. Depositors stake their shares (vault tokens) within their respective gauge which enables them to earn RBN rewards.

- Boosting the RBN rewards earned on their gauge tokens by 2.5x.

- Delegating boosts to others in exchange for bribes. This is great for veRBN holders who want to be rewarded for staking their RBN tokens even if they don’t have gauge tokens (those avoiding or not yet exposed to the options vaults).

- Bi-weekly voting on “gauge weights” (distribution of RBN rewards among all gauges). This allows veRBN with gauge tokens to potentially increase the allocation of RBN rewards to their gauges, or accept bribes from others to vote in a certain way.

- Receive higher shares of the protocol revenues. 50% of protocol revenues are converted to ETH and transferred veRBN holders as reliable cash flows.

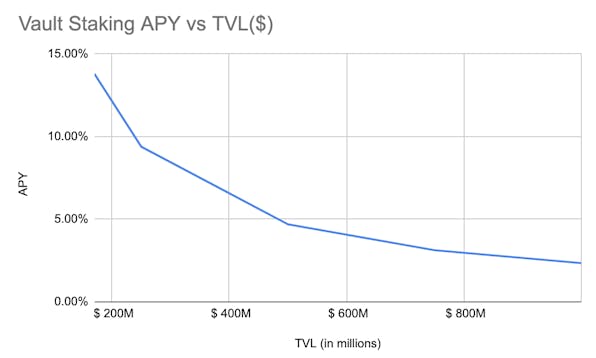

Keeping this emission schedule in mind, if the distribution of RBN rewards across chains remains largely equal, the effect on APYs for options vault staking as TVL grows is expected to be as follows:

Analysis

Currently, participation in staking is very low, with only about 800 wallets and ~6.3% of circulating supply locking their RBN for veRBN. Compared to the broader DeFi ecosystem, this is concerning. For example, Maple Finance, an institutional lending protocol, has a much higher 28% of circulating supply staked. On the other hand, there have been some bright spots for Ribbon. While the maximum lockup period for RBN staking is 2 years, the average lockup period till date has been a high 1.1 years. This is a reflection of how the APY rewards offered increases as time locked up rises. Furthermore, while there was a steep rise in cumulative tokens locked from March to July 2022, this has flattened after that period. These numbers may suggest that the Ribbon community is not active in governance or that there is not enough value attribution to Ribbon tokens. Fundamental usage of Ribbon is better represented in TVL in vaults.

Conclusion

DOVs express the key principles of DeFi with its sustainable yield, but is difficult to implement due to volatility of gas costs and low liquidity. Ribbon has become a dominant player as a first-mover whose strengths lie in TVL, vault performance, and various structured products. They have created a platform for eager traders who typically sway away from the usual high-risk, high-reward derivatives markets, and simplified this process into just one click.

Risks associated with using or investing in Ribbon are mostly correlated with market risk; if TVL goes down, overall Ribbon TVL may also decrease. DOV-specific risks are mitigated by Ribbon’s longevity and market share dominance. Plus, participation in RBN staking is very low. Nevertheless, they have a proven product and are continuing to innovate to ensure they retain leadership in the space.

Blockchain @ Georgia Tech Socials

If you enjoyed this deep dive stay up to date with Blockchain at Georgia Tech’s upcoming events and posts by following us on Twitter and LinkedIn! Sign up for our newsletter here!

Sources

https://docs.ribbon.finance/theta-vault/theta-vault

https://qcpcapital.medium.com/an-explanation-of-defi-options-vaults-dovs-22d7f0d0c09f

https://ribbonfinance.medium.com/algorithmic-strike-selection-e07ae917c146